Honda expects to sell 70,000 of its Prologue battery-electric vehicles annually after its launch in 2024 — but today warned it could fall short if federal lawmakers fail to take a “fair and equitable” approach to the new EV incentive program now being debated in Congress.

The Honda Prologue will be one of two BEVs that the carmaker plans to launch mid-decade, both developed and manufactured as part of a joint venture with General Motors. That’s part of its goal of having BEVs and other zero-emission vehicles account for 40% of its sales by 2030. Honda plans to subsequently introduce more BEVs of its own design.

“Launching our first volume BEV in 2024 is the start of an exciting new direction for Honda,” Dave Gardner, executive vice president of National Operations at American Honda Motor Co. Inc. said in a statement. “We are working with our dealers to plan the transition from sales of primarily gasoline-powered vehicles to selling 100% electric vehicles by 2040.”

Honda wants more money from Congress

President Joe Biden recently set a target that would have BEVs, PHEVs and fuel-cell vehicles, or FCVs, account for 50% of U.S. sales by 2030. To get there, the president is asking Congress to help fund a nationwide network of 500,000 chargers. Congress, meanwhile, is working up new EV sales incentives. But that has generated significant controversy as a plan approved by the House Ways & Means Committee would not only extend the current, $7,500 tax credits but add $5,000 for EVs and batteries built in the U.S. using union labor.

Honda last week condemned those provisions, sending a letter to Congressional leaders arguing that the plan “discriminates among EVs made by hard-working American auto workers based simply on whether they belong to a union.”

In the statement issued today, it followed up by saying reaching its 40% zero-emission target for the U.S. is “contingent upon fair and equitable access to state and federal EV incentives intended to encourage American consumers to purchase electric vehicles.”

Coming from behind

Honda was a pioneer of automotive electrification. Its original Insight, a high-mileage two-seater, was the first mass market hybrid to go on sale in the U.S., beating the Toyota Prius to showrooms by several months.

It briefly introduced a limited-volume battery-electric model, the EV Plus, in the late 1990s. And it followed up, nearly two decades later, with a battery-powered version of the Clarity line. That low-range model was dropped in 2020.

The automaker has come under increasing pressure to bring out a long-range BEV with key competitors like Toyota, Ford and even Subaru and Mazda getting into the growing electric vehicle market.

In April, Toshihiro Mibe, who became global president and CEO earlier this year, set a goal of having all Honda vehicles powered by some form of battery and hydrogen drive system by 2030. They are expected to generate 40% of its North American sales by the end of the decade, 80% by 2035, and 100% by the end of the next decade.

Honda turns to its partner

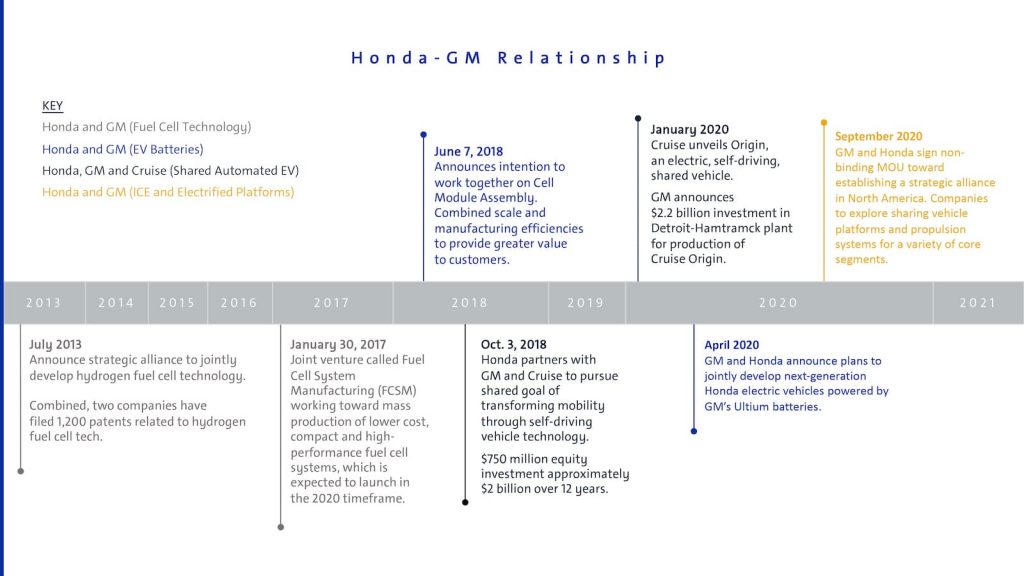

To speed up the process, Honda turned to General Motors — the two traditional rivals already having several joint ventures in the works, including one focused on fuel-cell technology, another on autonomous vehicles.

“Leveraging strategic partners to achieve scale and mitigate initial investment requirements” will let Honda bring a competitive battery-car to market sooner than it could on its own, Gardner acknowledged during a media briefing in June. “Our zero-emission focus has begun,” he said.

While the 70,000 sales target might seem modest compared to the volumes some new BEVs — particularly those from Tesla — are generating, the figure is roughly in line with annual demand for the Honda Pilot SUV.

A regional approach to sales

When it launched the original EV Plus, Honda focused primarily on the California market, the largest for BEVs. While manufacturers like Tesla, General Motors, Ford and Nissan now are rolling out their battery-electric cars nationwide, Honda plans to continue focusing on select markets with Prologue.

“Honda’s initial approach to selling the Prologue will be regional, focusing on California and the ZEV states, including the BEV-friendly Sunbelt states of Texas and Florida,” it said in a statement today. “Honda anticipates these regions will represent the bulk of sales at the onset of launch due to higher customer acceptance and regulatory requirements.

“As EV infrastructure expands and customer interest grows nationwide, the company will rapidly expand sales and marketing efforts to other areas of the country.”

More to come

The automaker has provided no specific details about Prologue’s drivetrain beyond the fact it will share the Ultium battery technology GM will launch later this year, starting with models like the GMC Hummer pickup and Cadillac Lyriq SUV. That would suggest that Honda’s electric SUV will deliver at least 250 miles or more of range between charges.

Honda has been completely mum about the second vehicle to come from its GM alliance. But it did note that subsequent battery-powered cars will rely on its own new e-Architecture. That is expected to follow the same skateboard-style approach used for Ultium, with its batteries and key drive components mounted below the load floor.