Toyota is just gearing up to reopen its sprawling North American production network – but the automaker expects to assemble nearly a third fewer vehicles from April through the end of October than originally scheduled, according to a Reuters report.

Some of the lost production can be accounted for by the ongoing shutdown of virtually all vehicle operations in the U.S., Canada and Mexico due to the coronavirus pandemic. But it also appears to reflect both the challenges of restarting production and the anticipated slow recovery of the regional new car market.

From April through the end of October Toyota plans to build about 800,000 cars, trucks and crossovers in North America, down 29% from what it produced during the same seven-month period a year ago. Prior to the pandemic, Toyota actually had hoped to increase North American output, so the new numbers come in about 32% below that plan.

(Toyota marks 20th anniversary of “the car that changed the world” with special edition Prius.)

“The general direction of it seems accurate,” a senior company executive told TheDetroitBureau.com, asking for anonymity due to the nature of the subject.

Despite putting together an extensive playbook to restart its North American operations, it’s going to take some time to get back to normal.

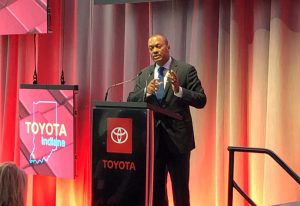

Some cuts would seem impossible to avoid considering Toyota’s North American plants will have been shuttered for close to two months. They’re now just gearing up and the restart process won’t be quick or easy, Chris Reynolds, Toyota’s Chief Administrative Officer for North American manufacturing operations, said during a media webinar in late April.

The automaker has put together and extensive playbook that calls for social distancing wherever possible, the use of masks and other personal protection equipment, and other steps that will take time, said Reynolds, to adapt to.

“There is no going back to the normal for the foreseeable future,” said Reynolds. “We have to adjust to the new normal.”

(Toyota becomes latest to delay reopening of plants.)

At least initially, he and other Toyota officials said, production will ramp up slowly, starting with single shifts, even in plants that were previously struggling to meet demand running 24 hours a day.

According to the source who spoke to Reuters, Toyota expects to produce only about 10% as many vehicles in May as it had originally planned for. The automaker wants to be approaching normal levels of production by July.

Toyota’s Chris Reynolds said earlier this year that there’s “no going back to normal for the foreseeable future.”

That could leave the automaker struggling for product in some key market segments. Demand for full-size pickups, such as the Toyota Tundra, remained strong even during the worst of the pandemic lockdown, according to J.D. Power data, the research firm’s analysts warning during their own webinar last Wednesday that there could be shortages pop up in some product niches as sales begin to recover. The automaker’s RAV-4 SUV, it’s best-selling model in the U.S., has also retained relatively strong ales during the pandemic.

For now, though, U.S. dealers generally have solid supplies of most product lines, and Power data chief Thomas King last week said he did not see the American new car market getting anywhere close to pre-pandemic levels until July, at the earliest. He also warned that sales for the year could dip as low as 13 million compared to the 17.1 new vehicles sold in 2019.

(Toyota reveals “flexible” plan aimed at safely starting to re-open U.S. plants.)

How the pandemic-led production shutdown and sales slump have impacted Toyota should begin to become apparent when it releases its earnings report for the January-March quarter on Tuesday. But the broader effects likely won’t become clear until the books are closed on the following quarter.